- #DOES BITPAY REPORT TO IRS HOW TO#

- #DOES BITPAY REPORT TO IRS SOFTWARE#

- #DOES BITPAY REPORT TO IRS PROFESSIONAL#

New data from BitPay shows that American consumers are flocking to load the first Mastercard branded BitPay card with top digital assets. BitPay complies with the requirements of Section 6050W of the Internal Revenue Code. Simply upload or add the transaction from the exchanges and wallets you have used, along with any crypto you might already own, and we'll calculate your capital gains. This Section requires payment processors to provide information to the IRS through Form 1099-K reporting. I can only be taxed when I take my income I made outside of the IRS and put it in a regulated system that is connected to the IRS in other words Cashapp, BitPay and the like. BitPay, one of the biggest cryptocurrency payment processors, will pay $507,375 to settle its potential civil liability for apparent violations of U.S. 1099 forms come in a variety of shapes and sizes (which you can learn about in our crypto 1099 form guide) - but what you need to know is that whenever you get a copy of a.

If you're cashing in some of your Bitcoin this year, the IRS wants to know about it. Keep good records of your transactions and your basis in your cryptocurrency assets. Once the Form 1099-B reporting is implemented, the IRS will specifically know what types of cryptocurrency you buy and sell throughout the year. This requirement only applies in the case of merchants that receive payments from BitPay of. Let's say you actually purchased your BTC from before at $15,000 instead of $2,000. ACH and direct deposit are both supported. The Internal Revenue Service (IRS) is aware that "virtual currency" may be used to pay for goods or services, or held for investment. Who can access the cointracker report? They set out to revolutionize the financial industry - making payments faster, more secure and less expensive globally. The IRS previously probed Coinbase and its customers in 2017. Bitcoin used to pay for goods and services taxed as income If you are an employer paying with Bitcoin, you must report employee earnings to the IRS on W-2 forms. Employees must report their total W-2 wages in dollars, even if earned as Bitcoin. Does Coinbase report to the IRS? Compliance efforts have continued since then. High Account Limits - BitPay's daily deposit limit is $10,000, while the overall deposit limit is $25,000 per card. Since the IRS considers bitcoin transactions to be sales of property, gains and losses in the value of bitcoin you spend are subject to capital gains taxes. Originally started by John Dundon, an Enrolled Agent, who represents people against the IRS, /r/IRS has grown into an excellent portal for quality information from any number of tax professionals, and Reddit contributing members. Bitcoin is really just another form of gambling. Specifically, the letter asked the IRS to specify acceptable methods for calculating the virtual currencies’ cost basis, cost basis assignment and lot relief, as well as tax treatment of crypto hard forks, citing bitcoin’s fork bitcoin cash ( BCH) that took place in August 2017.Obviously, we are all expected to report our financial information to the IRS. The action took place before the filing deadline for federal income tax returns on April 15, 2019.

#DOES BITPAY REPORT TO IRS HOW TO#

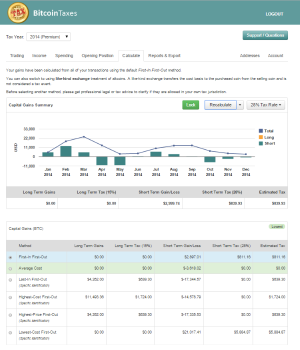

federal representatives sent a bipartisan letter to the IRS requesting guidance on how to report virtual currency taxes. Once calculated, capital gains and income reports can be downloaded or uploaded directly into Form 1040 Schedule D. The service will allow users to import trading data directly from major exchanges.

#DOES BITPAY REPORT TO IRS SOFTWARE#

In February, United States tax preparation software TurboTax Online partnered with CoinsTax, LLC to add cryptocurrency tax calculation to its services.

The product can reportedly get information about crypto transactions from “virtually all” major exchanges, consolidate data from various sources, and automatically produce reports, including cryptocurrency-related IRS tax returns.

#DOES BITPAY REPORT TO IRS PROFESSIONAL#

Last month, Big Four auditing and professional services firm Ernst & Young launched a tool for accounting and preparing taxes on cryptocurrency holdings. Leading financial industry players have been steadily embracing the tax issue when dealing with cryptocurrencies.

0 kommentar(er)

0 kommentar(er)